What Does Top 30 Forex Brokers Do?

What Does Top 30 Forex Brokers Do?

Blog Article

Facts About Top 30 Forex Brokers Revealed

Table of ContentsUnknown Facts About Top 30 Forex BrokersThings about Top 30 Forex BrokersThe Greatest Guide To Top 30 Forex BrokersThings about Top 30 Forex BrokersIndicators on Top 30 Forex Brokers You Should KnowThe smart Trick of Top 30 Forex Brokers That Nobody is DiscussingMore About Top 30 Forex BrokersThe Buzz on Top 30 Forex Brokers

Like various other circumstances in which they are utilized, bar graphes provide more price information than line charts. Each bar graph stands for one day of trading and contains the opening price, highest cost, cheapest rate, and closing cost (OHLC) for a trade. A dashboard on the left represents the day's opening cost, and a comparable one on the right stands for the closing cost.Bar graphes for money trading assistance investors determine whether it is a customer's or seller's market. Japanese rice investors first used candle holder graphes in the 18th century. They are aesthetically extra appealing and simpler to review than the graph types defined over. The upper section of a candle is used for the opening cost and greatest rate point of a currency, while the lower part suggests the closing cost and most affordable price factor.

More About Top 30 Forex Brokers

The developments and forms in candlestick charts are made use of to recognize market direction and movement.

Banks, brokers, and suppliers in the foreign exchange markets permit a high quantity of utilize, implying traders can regulate huge positions with fairly little money. Take advantage of in the series of 50:1 is common in forex, though even greater quantities of utilize are readily available from particular brokers. Utilize has to be used meticulously due to the fact that lots of inexperienced investors have experienced significant losses using more take advantage of than was essential or prudent.

The Of Top 30 Forex Brokers

A currency investor requires to have a big-picture understanding of the economies of the numerous countries and their interconnectedness to comprehend the fundamentals that drive currency worths. The decentralized nature of forex markets implies it is less controlled than other financial markets. The level and nature of guideline in forex markets depend on the trading territory.

The volatility of a specific currency is a function of numerous aspects, such as the national politics and business economics of its nation. Occasions like financial instability in the form of a repayment default or imbalance in trading connections with another currency can result in significant volatility.

The 2-Minute Rule for Top 30 Forex Brokers

The Financial Conduct Authority (https://worldcosplay.net/member/1702874) (FCA) screens and manages foreign exchange professions in the UK. Money with high liquidity have an all set market and exhibit smooth and foreseeable price action in feedback to exterior events. The U.S. buck is the most traded currency worldwide. It is coupled up in 6 of the marketplace's seven most liquid currency sets.

Fascination About Top 30 Forex Brokers

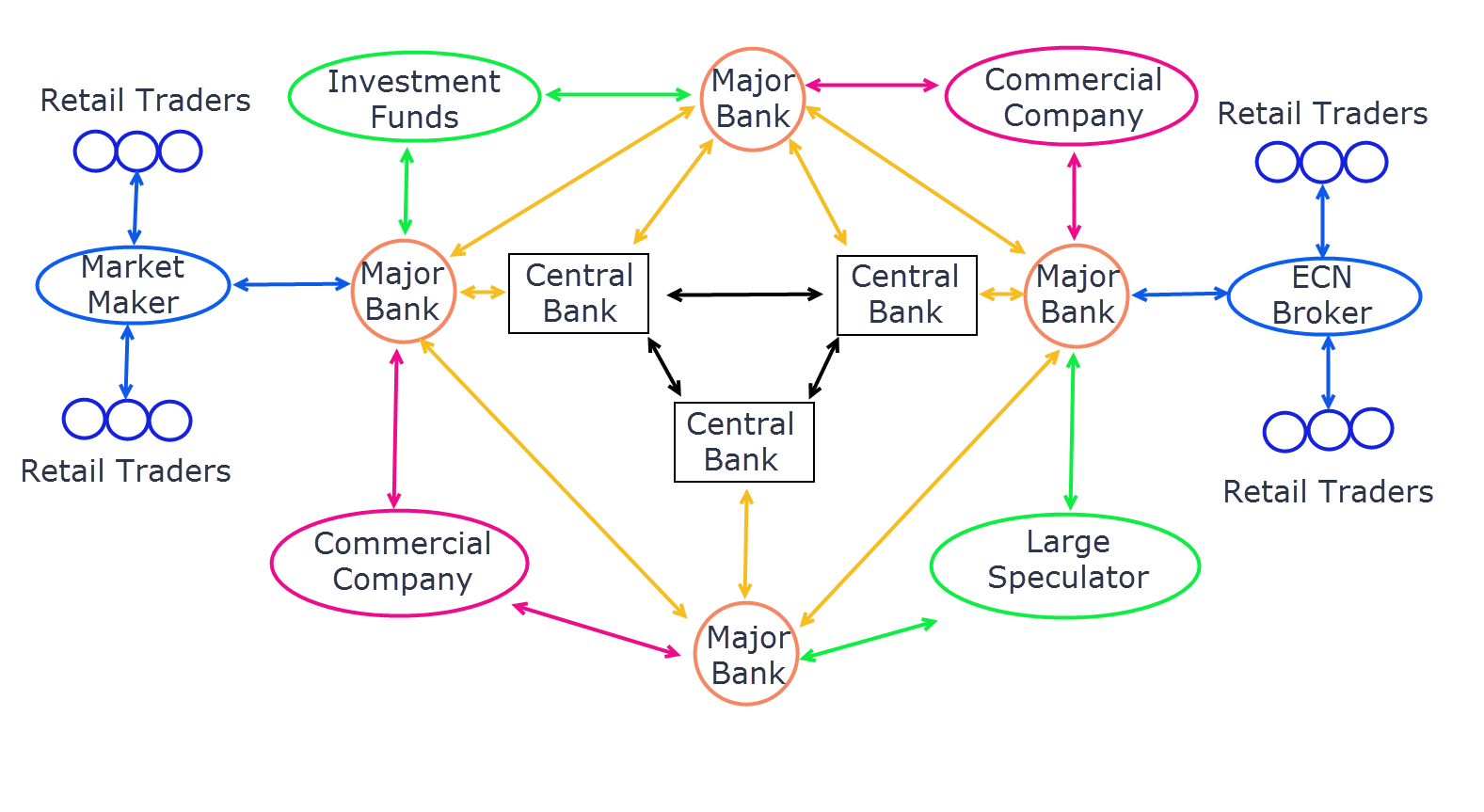

In today's information superhighway the Foreign exchange market is no much longer entirely for the institutional capitalist. The last 10 years have actually seen an increase in non-institutional traders accessing the Forex market and the benefits it supplies.

The Best Guide To Top 30 Forex Brokers

International exchange trading (forex trading) is a global market for getting and selling money. At $6. 6 trillion, it is 25 times bigger than all the globe's supply markets. Forex trading determines the exchange prices for all flexible-rate currencies. Consequently, rates change frequently for the currencies that Americans are most likely to make use of.

When you market your money, you receive the repayment in a various currency. Every tourist who has obtained foreign money has done foreign exchange trading. The investor gets a specific money at the buy rate from the market maker and sells a various currency at the marketing cost.

This is the purchase price to the investor, which in turn is the revenue made by the market manufacturer. You paid this spread without recognizing it when you exchanged your dollars for international currency. You would certainly observe it if you made the deal, canceled your trip, and then tried to trade the currency back to bucks right now.

Top 30 Forex Brokers for Dummies

You do this when you believe the money's worth will certainly drop in the future. If the money rises in worth, you have to acquire it from the dealership at that price.

Report this page